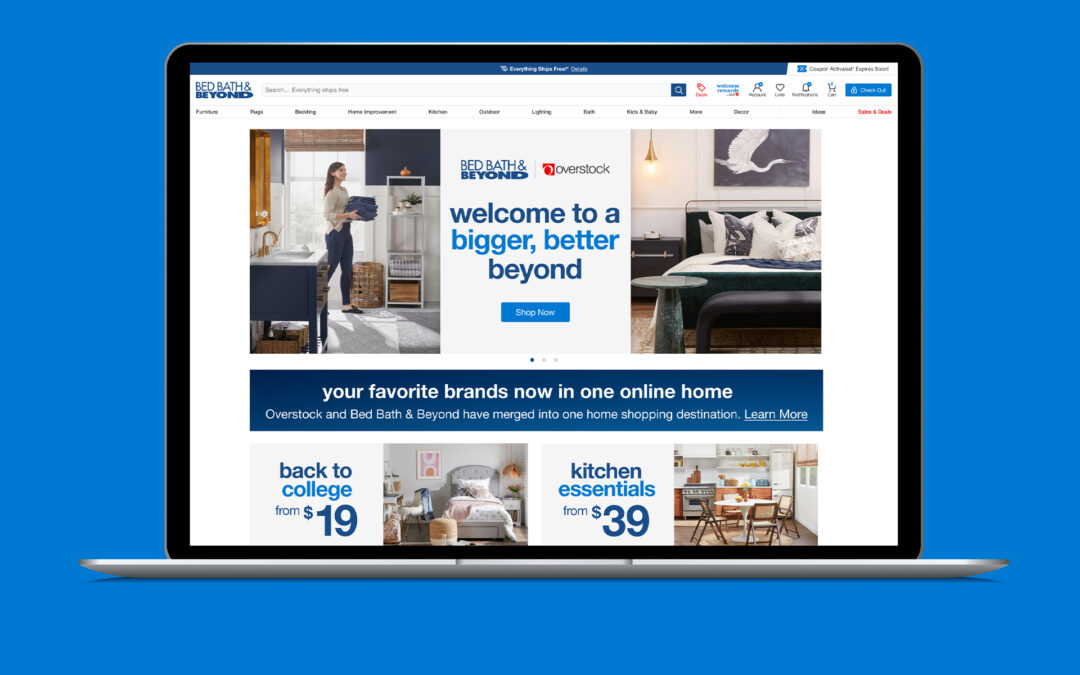

The 2023 Omnichannel Experience Index study by Incisiv, in collaboration with Blue Yonder and Microsoft, recognized retail leaders that offer the richest omnichannel experience maturity across the four key areas, and it includes a company that once resisted diving into e-commerce, Bed Bath & Beyond.

- Bed Bath & Beyond

- Best Buy

- BJ’s

- Crate & Barrel

- Kroger

- Levi’s

- Lowe’s

- Neiman Marcus

- Nordstrom

- Petco

- Target

- Home Depot

- Tractor Supply

- Walgreens

The study found that shoppers are increasingly leveraging digital platforms, with 93% of all shopping journeys now starting online, up from 81% in 2020.

The study suggested that keeping up with e-commerce will be an ongoing test for retailers across the four key areas considered: Inventory Visibility, Frictionless Fulfillment, Cost and Payments, and 360-Degree Service.

For omnichannel retailers, ever-evolving shopper expectations make it more challenging to meet and exceed consumer expectations. As such foundational capabilities have to keep up with evolving expectations.

Key findings of the report include:

- Inventory Visibility. These days, 46% of shoppers check stock availability online before making a purchase, and 55% want to browse products online to see what’s available in nearby stores. So, now, 36% of retailers in the leader category provide real-time inventory status, while 67% of retailers assessed in the report have inventory status callouts such as selling fast, in-stock and out of stock.

- Frictionless Fulfillment. The study determined that 56% of shoppers have abandoned their online shopping carts due to concerns about delivery time. It also found that 75% of shoppers expect their purchase delivery within two days or less, so transparency about delivery timeline is vital. Displaying the delivery time frame gives the shopper clarity, but only 9% of retailers show order dates per destination code on the product listings pages.

- Cost and Payments. With digital shopping loyalty low and expectations high, 45% of online shoppers defect for better deals and 79% of shoppers value unlimited free delivery programs. Consumer electronics retailers are most likely to offer free delivery at 40%, but industry average adoption for free shipping on all orders is just 11%.

- 360-Degree Service. Today, 95% of shoppers will remain loyal to a retailer with a self-service return process, and 49% of shoppers actively check retailer returns policy before purchasing. Beyond that, 86% of shoppers say they will pay 15% more for a seamless customer service experience. The study revealed that 62% of retailers now enable customers to initiate returns online, up from 51% in 2021.